Overview

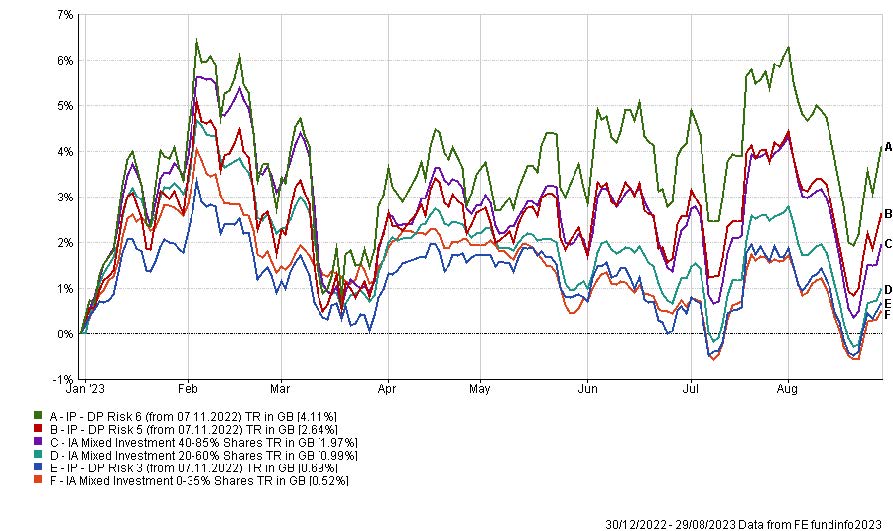

Summer has offered no respite from the challenging markets that 2023 are delivering. As the chart below highlights, August has seen further declines as investors fret over the health of the Chinese economy, concerns that US interest rates may stay higher for longer, a pessimistic outlook for earnings and the rating agency, Fitch, downgrading long term ratings of the US, which came as a surprise to markets.

There is most definitely a negative sentiment washing across markets, and most of the news creates pessimism.

Investing in Cash

There are, of course, reasons to be optimistic but with all the negative news now, it is perfectly understandable that investors see advantages in keeping more of their wealth in cash. Nevertheless, history shows that markets will bounce back from such periods of doom and gloom and deliver ahead of inflation, which cash does not.

Positives

- Cash rates of 4% or more can be found, which are an appealing return and will not lose value in nominal terms, subject to any banking risks that we have recently discussed here.

- Cash rates should increase as interest rates rise, which seems likely.

If inflation proves stubborn, which looks very possible, and interest rates need to move higher or stay high for a while, then cash rates should benefit from this. If inflation falls below cash rates, then investors will make gains in real terms for a period. - Cash can help shelter portfolios from short-term market volatility and is essential for short term needs. Cash can provide peace of mind and avoid the stress and anxiety of market movements.

Negatives

- However, cash rates will decrease as interest rates fall, reducing returns; and we know providers are very fast to cut rates on products as interest rates come down. Consensus suggests we are nearing peak rates.

- Yields on bonds are always typically higher than those from cash.

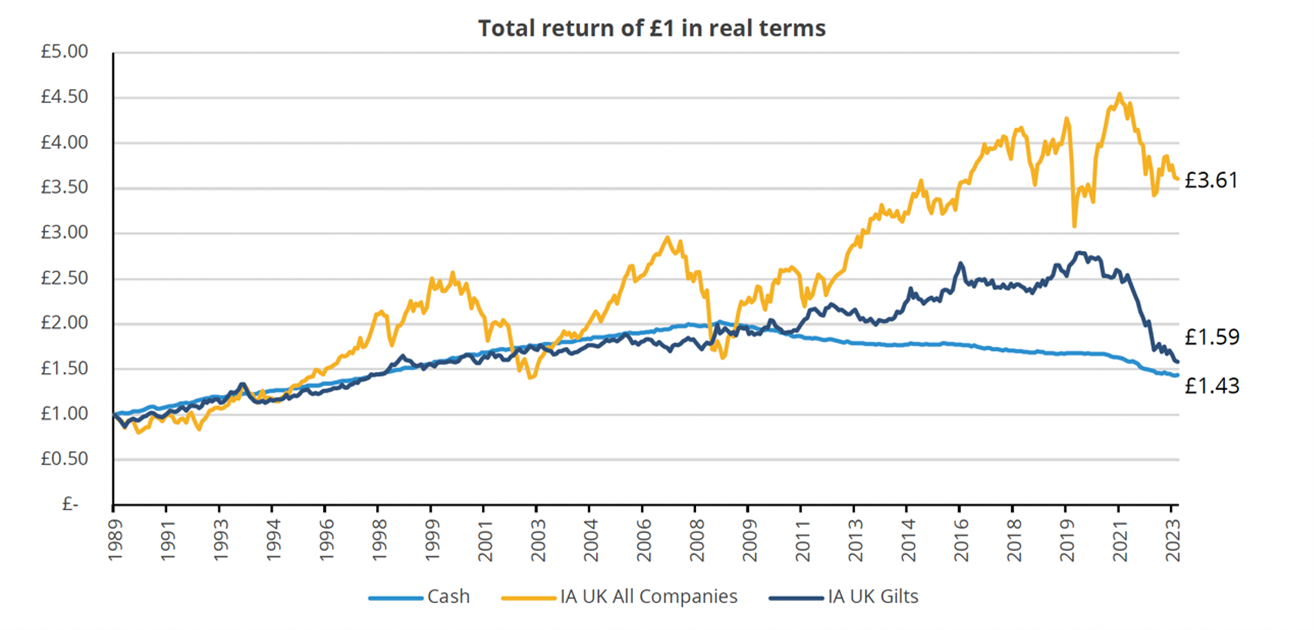

The UK 10-year government bond is currently yielding around 4.5% and corporate bond markets around 6%. Bond yields will likely fall as interest rates drop and this should increase bond prices, therefore adding capital growth (a feature often overlooked). For example, a 1% fall in yields should lead to a capital gain of circa.10% for a 10-year bond. - Historically both bonds and equities have proved to deliver returns ahead of cash rates over the long term. Of course, it could be different this time, but that would seem unlikely. The chart below provides a very clear picture of the long-term outcome (Source: Square Mile and FE fundinfo. Data as at 30th June 2023):

- In addition, to get the best rates, cash often needs to be held on account or invested for a specified period to capture the full rate. Breaking the term is costly and your money is effectively tied up and unavailable for investment when markets improve.

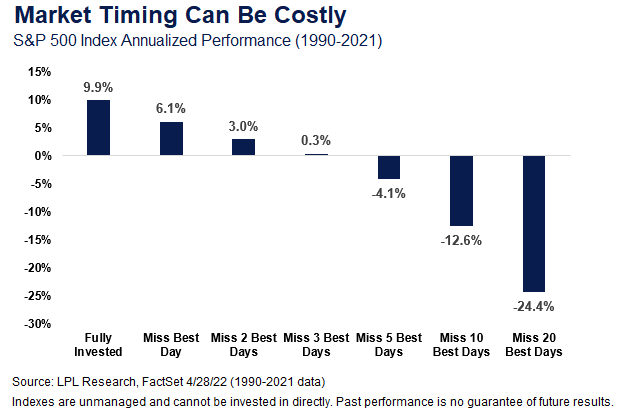

As we have often discussed, being out of the market, for both bonds and equities, on days when markets move up very sharply severely reduces the long term returns for portfolios.

As we have often discussed, being out of the market, for both bonds and equities, on days when markets move up very sharply severely reduces the long term returns for portfolios.

The impact of not being invested on the best days could be very expensive, as the chart shows.

Such days often happen when markets are volatile and performing at their worst, i.e. the conditions we are experiencing just now.

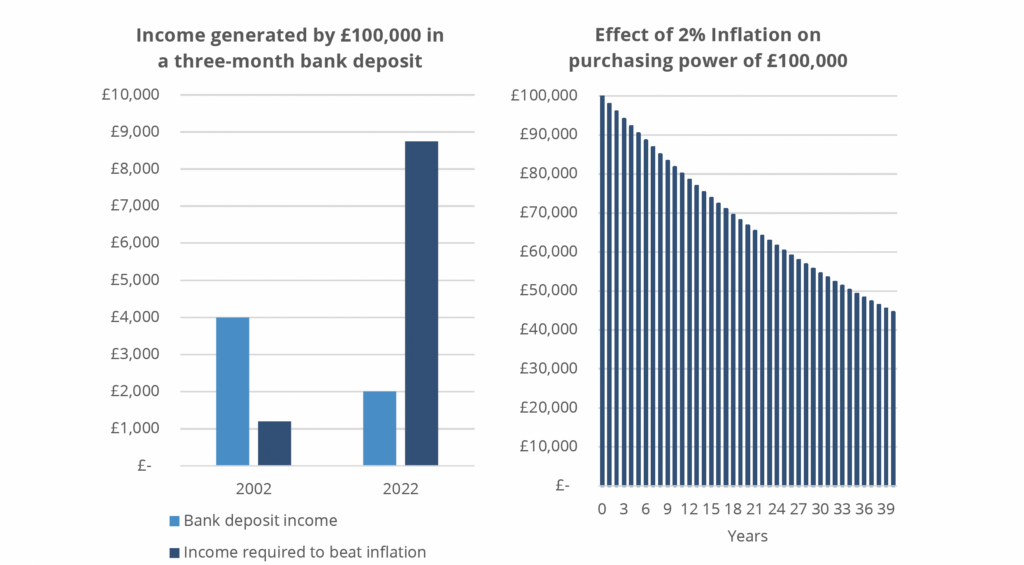

- For cash rates to outpace inflation, the rate paid needs to be higher than the inflation level. As the chart shows, this is not the case with inflation just below 7%, and whilst interest rates may have further to rise, it is unlikely they will exceed the inflation rate for any prolonged period, if at all.

The chart above (Source: Square Mile and FE Fund Info) shows how inflation diminishes the value of your money in real terms, which is a very expensive trade-off.

The chart above (Source: Square Mile and FE Fund Info) shows how inflation diminishes the value of your money in real terms, which is a very expensive trade-off.

This trade-off may be worth it for those with very little appetite for investment risk, however for everyone else, cash makes sense for short-term rather than long-term goals.

Our portfolios are structured to include cash for such short-term needs. However, investing in the markets has been shown to serve you better over the longer term and we do not believe it is advantageous to duck and dive in and out of the market. Timing the market is impossible and success is mostly down luck.

Conclusion

Current market conditions are very unsettling, and the strong temptation is to seek the safety of cash. However, it is worth bearing in mind that such a strategy brings other risks that can be detrimental to portfolios.

Long term, a diversified balanced portfolio has delivered much more than cash, and that is very likely to remain the case. It is hard to remain patient but that is what is required.

Douglas Kearney C.A. Investment Director

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.