Investors have endured a volatile but ultimately a pretty flat ride in 2015 as the economic slowdown in China and emerging markets more generally has weighed on global activity. Despite aggressive monetary easing, European growth has also disappointed some of the more bullish expectations and while US GDP growth has been more robust, activity has faded recently as the oil industry has contracted due to the fall in the oil price.

Despite this, some areas of the FTSE All-Share have enjoyed strong relative returns in particular domestically-facing sectors. Investors view them as beneficiaries of a robust UK economy, low interest rates and falling commodity prices. However, other sectors, especially those exposed to global trends (such as commodities or Asian Financials) have been under pressure in 2015 and have underperformed materially, with large-cap UK listed oil and mining companies the most obvious examples.

Market confidence was undermined in the summer by a combination of the devaluation, albeit small, of the Chinese currency and the prospect of rising interest rates in the US. Together these developments suggest that the status quo of ultra-loose monetary policy in the US and a pegged currency in China is coming to an end. In this respect, the underlying economy in China is perhaps less resilient to an appreciating renminbi than previously thought and is going through a period of profound structural change.

2016 is more likely to represent a slowdown phase in the business cycle, a period in which equities overall will still generate positive returns, although with wider dispersion and more volatility, a trend already well established. In addition, capital returns will be harder to sustain and therefore income such as dividends and special returns of capital will become an even more important factor in overall returns for equity investors.

This time last year, most economic forecasters were anticipating a mild acceleration in global GDP growth. It didn’t materialise. Looking ahead to 2016, economists are once again expecting global growth to accelerate as the weight on activity from the fall in commodity prices fades and healthy domestic demand growth in the developed economies drags industrial production and investment up to meet that demand. However, survey data suggest that risks remain heavily-tilted to the downside. Emerging markets remain the biggest source of concern, with Chinese, Indian and Russian firms’ confidence all sinking in the latest survey, though there are signs that the pessimism of Brazilian firms may have troughed. With confidence levels in the US and Eurozone also deteriorating, investors in the developed economies are getting a sharp reminder of how much the rest of the world matters.

The Japanese equity market has seen optimistic economic forecasts continue to be scaled down as the year has progressed, but it has still managed to post acceptable gains in what has been a challenging environment. In general, we believe Japan’s economy is heading in the right direction with the overall trend for the Japanese economy remaining positive. In an environment of low growth and low inflation, we see the Japanese market being supported by firm corporate earnings growth and growing returns to shareholders. Furthermore, the price-to-earnings multiple of the Topix benchmark (based on forward earnings) is still at a reasonable level of 15-16 times. We feel that lower global economic growth has been sufficiently discounted in share prices and in some cases the negative impact from China’s slowdown may have been overestimated.

China and Emerging markets will be in the spotlight through 2016. The slowdown in China impacted global markets over the summer and undoubtedly if economic data continued to disappoint this would have a significant negative impact on all markets. It would be hard to argue that we will see a major upward revision to anticipated Chinese growth, but equally the talk of its demise may be exaggerated. China will, though, be critical to global growth during 2016 and beyond

In Europe, earnings recovery should support further stockmarket gains in 2016. Corporate profit margins within the Eurozone particularly remain at depressed levels relative to the US. This gap has been significant since the global financial crisis and a narrowing of the disparity would support European equities. At the same time, valuations are compelling versus historical levels and most other equity markets. From an economic perspective we are optimistic that the Eurozone recovery will continue through 2016 despite the emerging market turmoil witnessed during the late summer. The export market is clearly suffering but overall the data suggest to us that the Eurozone economy has momentum in its recovery phase driven by domestic demand, credit expansion and consumption growth. It’s worth noting that services and construction make up 75% of German GDP and these areas of the economy are performing well. The same can be said for other large Eurozone member countries. Amidst some market uncertainty, Europe looks relatively well positioned in what is a low nominal growth world. However, it is by no means a given that Europe will escape a soggier growth environment.

In the UK, the economy continues to repair and we expect growth to remain positive but not spectacular. There will be much talk of interest rates rises following the FED’s recent decision. The Bank of England may delay raising interest rates into the second half of the year if indeed at all in 2016. The major risks to this view are much weaker than expected global growth and/or a significant economic impact from “Brexit” uncertainty. It would be hard to imagine that the FTSE 100 will not pick itself off the ground during 2016, but it could have another poor year as it is so heavily weighted by companies in sectors that are out of favour. Our focus will be watching the performance of mid and small caps which have performed strongly for a while now.

The US continues to offer opportunities for active fund managers and we think that will continue to be the story through 2016. It is too early to make any judgements on the impact of the recent rate rise but no one could argue that it took them by surprise. It is a general perception that when policymakers embark on a period of monetary tightening equity markets struggle. Rising interest rates lead to higher costs of borrowing, therefore there is less free cash flowing through the economy, restricting consumer spending and impacting growth, which hits corporate earnings and profitability and is reflected in companies’ share prices. Whilst that may be true among individual companies it does not appear to have deterred investors in stockmarket. European, U.S. and UK equity markets, on average, historically have all risen in the year after policymakers have begun raising interest rates: The UK stockmarket has risen on average 17.9%. The US stockmarket has risen on average 3.4%.The European stockmarket has risen on average 11.7%.

Property is expected to continue to deliver satisfactory returns, albeit unlikely to match the levels experienced over the last two or three years. More of the return is likely to be delivered through income growth rather than capital growth, but as yet there is no strong evidence of over supply or overheating.

Fixed income is likely to remain challenging through 2016 as it has been through this year. Government and U.S treasuries remain unappealing and our strategy will remain focussed on the flexibility that a strategic bond fund offers. We will continue to monitor fixed income closely and meet up with a variety of fixed income managers to ensure that we have the fullest picture of the fixed income landscape.

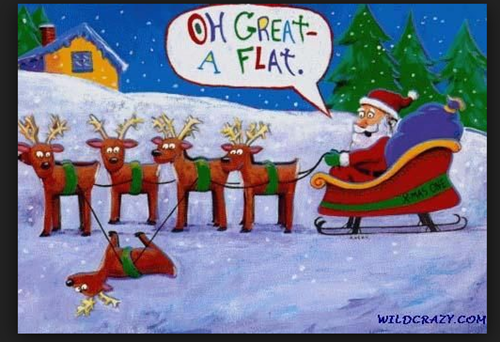

As 2015 comes to a close, there will be few that will mourn its passing. It has been a difficult and volatile year and produced few pleasant surprises. Our message remains that the funds that we support comprise a wealth of interesting and growing companies that are selected after deep and detailed due diligence. Whilst the macro picture cannot be ignored, it is the quality of the individual companies and their strength of cash flow and earnings that the fund manager commits with conviction. Difficult years are no fun, but over time quality will provide rewards. All of us at Intelligent Pensions wish you a Happy Christmas and a prosperous New Year.