We continue to live in a world of extraordinary monetary policy, where investors are no longer surprised by central bank easing and, indeed, have come to expect it. Thus the equity market rally continued into August, buoyed in the UK by the widely expected announcement of a Bank of England base rate cut to 0.25% – the lowest it has been in the Bank’s 322-year history – along with the expansion of quantitative easing. That made for a package of complementary measures to support the UK economy following the uncertainty of the Brexit vote.

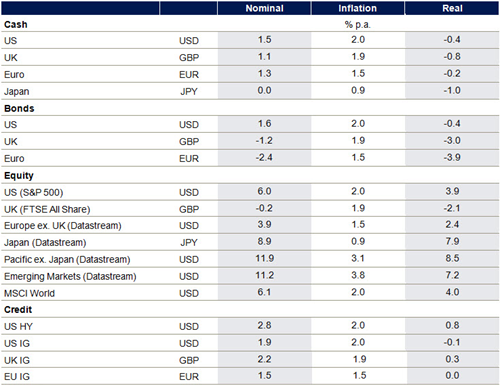

Globally, divergent monetary policy is going to be a major influence on asset classes, with investors having ever fewer places to go in their search for yielding assets. This is likely to be the dominant theme in the global economy for the coming months and maybe years. Schroders has just released its seven year view of asset class return performance as can be seen in the table below. Cash and bonds now universally appear to offer a negative real return, while all equity markets bar the UK offer positive returns. Credit markets find it difficult to escape the pull of negative rates in bonds and cash, but still offer some small inflation-adjusted gains. Equities appear to offer the most postitive returns, with Pacific, Japan and emerging markets the strongest runners. This view is shared by other long term data that we study. Perhaps, not surprisingly, following Brexit, the UK is looking weak.

It is pleasing that our global strategy has affirmation that we are investing in the geographic areas with the forecast highest returns. It would be unlikely that we would exclude UK markets from our portfolios but this and other such information will be digested to assist in forming our ever developing strategies. Not unexpectedly, the fixed income world looks as though it will remain challenging but in our view it has a place in portfolios and that is unlikely to alter. Undoubtedly, we will alter the tiller between corporate, investment grade, high yield and strategic bonds as market conditions develop and change but it would seem government bonds will continue to look unappealing.

Although the returns, allowing for inflation, are perhaps not stellar they are in the main positive, apart from cash and bonds. Frequently investors struggle to committ to investing fearing loss and the inevitable volatile ride along the the road. Many continue to prefer to hold cash as it is not volatile and the fear and dread of loss is banished.

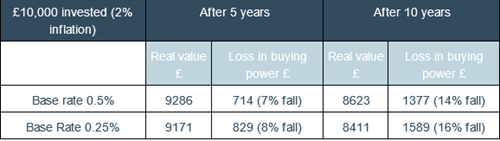

That, though, may be a hugely misunderstood strategy and creating real loss by default.

The table that was recently produced clearly demonstrates that holding cash in a low interest world performs in a way that most, if not all, investors would not tolerate from their investment portfolios. It is hard to imagine that over 10 years markets would fall by 16%. It is true that past performance is not necessarily indicative of future results but a look back does provide some significant comfort.

A review of performance of several asset classes and two mixed funds over the last 10 years, which includes the period of the global financial crisis, clearly shows that returns are massively greater than holding cash. Thus it is a bit of mind games that investors need to grapple with. The constant flow of news often portrays a very gloomy picture day to day and we seem unable to step back and look at the longer term and what has been achieved over time. It is galling and gut wrenching to make the investment plunge and then within a day or two hear some dire news impacting global markets. Oh why did we not just hold on to the cash?

The reason, hopefully, should now be a little clearer that taking a long term view, stepping back and letting the fund houses perform should bring much greater rewards than taking the somewhat mistaken route of holding cash. There can be no guarantees in investing, but it seems that cash offers a guarantee of losing 16% of buying power, which isn’t the greatest guarantee on offer.

Meanwhile markets continue to progress with an ever growing likliehood of an interest rate rise in the US before the end of the year. Retail property funds are repairing and cash is being generated at very acceptable prices. It looks like this was not the year to sell in May.