The Coronavirus is an unprecedented event with wide reaching and unknown impacts on the global economy. The timescales are uncertain and stock markets are reacting to that uncertainly with significant volatility.

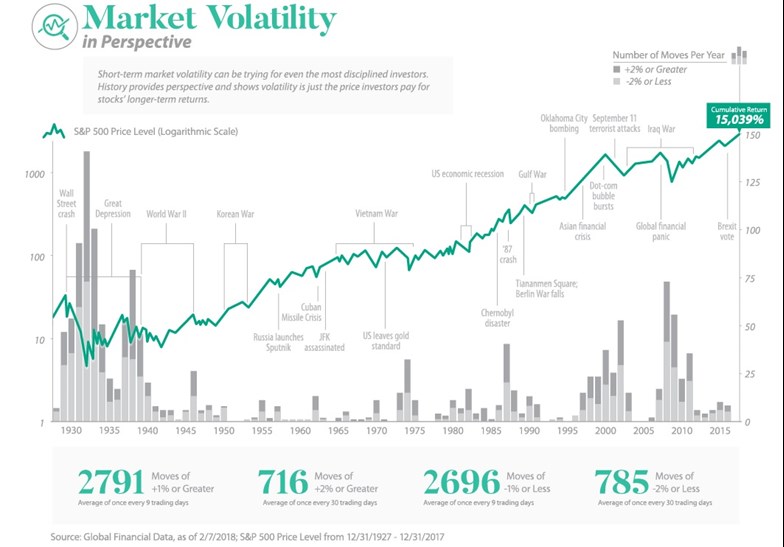

As you are probably aware, our investment philosophy is long-term, with a horizon of five years and beyond. Moreover, we have been investing in this way since Intelligent Pensions started in 1998 so it has been tested in all sorts of turbulent times. In the last 20 years we have experienced several global crises, each different from the last, but with the same recurring lesson – that our long-term investment horizon, our calm heads, and a supportive client base, will see our clients’ portfolios emerge from the current crisis robustly.

It is important not to lose sight of the fact portfolios have had a very strong previous 3 years. In addition, we continue to operate diversified portfolios with a range of lower risk fund holdings which, where required, can be used to generate income and avoid crystallising losses in equity funds.

We can’t make any promises about the stock market and would never try to call the market but our current view remains to avoid any unnecessary investment rebalancing until markets stabilise.

If you are taking an income from your plan, an alternative and possibly more effective strategy would be to stop or reduce your withdrawals where you can afford to do. Please contact your Retirement Analyst or our Head Office team to discuss your options.